Awards Before March of 2024

If you need information about VHIP awards granted before 2024, please refer to our original VHIP page. The initial VHIP funding was sourced from State Fiscal Recovery Funds, which had different regulations. The requirements and options outlined here do NOT apply to projects approved before March 25, 2024.

The Vermont Housing Improvement Program (VHIP) is relaunching as VHIP 2.0!

Drawing from insights gained over the past 3 years and more than 500 units funded, this updated program maintains our commitment to expanding affordable housing. VHIP 2.0 now offers awards for limited new construction. Additionally, it introduces a 10-year forgivable loan alongside the existing 5-year grants, aiming to further incentivize landlords. This new option requires renting units at fair market prices without the need for referrals from Coordinated Entry Organizations.

Table of Contents:

- What can you do with VHIP 2.0 funding?

- How much funding are projects eligible for?

- What are the program requirements?

- 5-Year Grant Versus 10-Year Forgivable Loan

- VHIP 2.0 Documents

- Resource Guide for Property Owners

- Fair Market Rent (Recertification)

- FAQ’s

- Recertification

- VHIP Recipient List

- Connect with your Local Homeownership Center to Apply

What can you do with VHIP 2.0 funding?

VHIP 2.0 offers grants or forgivable loans to:

- Rehabilitate existing vacant units

- Rehabilitate structural elements effecting multiple units, such as the roof of a multi-family property

- Develop a new Accessory Dwelling Unit (ADU) on an owner-occupied property

- Create new units within an existing structure

- Create a new structure with five or fewer residential units

- Complete repairs necessary for code compliance in occupied units (only eligible for 10 year forgivable loan)

Rehabilitation projects can include updates to meet housing codes, weatherization, and accessibility improvements, of eligible rental housing units.

How much funding are projects eligible for?

Based on the type of project, property owners are eligible to receive up to:

- $30,000 per unit for rehab of 0–2-bedroom units

- $50,000 per unit for rehab of 3+ bedroom units, structural elements impacting multiple units*, new unit creation, or creation of Accessory Dwelling Units (ADUs)

*Structural repair grant or loan awards are available for a maximum of $50,000 per award made for a property. For each structural award made, a rent-ready unit in the same building must be encumbered with a VHIP Covenant or FLA/Promissory Note. Contact your HOC or DHCD for more details and to discuss your project if you are considering structural repairs that affect more than one unit.

What are the program requirements?

Program Match: All participants are required to provide a 20% match of the award, the option for an in-kind match for unbilled services or owned materials. For example, a participant who receives an award of $50,000 will be required to provide a $10,000 match.

Fair Market Rent: Participants are also required to sign a rental covenant agreeing to charge at or below HUD Fair Market Rent (FMR) or voucher amount for the length of the agreement (5 or 10 years, learn more about these options here). Participants will be required to submit a yearly recertification form to ensure they are in compliance with the program requirements. To calculate HUD FMR for your area, check out our resources on Fair Market Rent.

Landlord Education: VHIP 2.0 applicants must watch a Landlord-Tenant Mediation video and complete a Fair Housing Training as part of the application process. The Landlord-Tenant Mediation video is provided by the Vermont Landlord Association (Please click here to view). The online, self-paced Fair Housing training is provided by CVOEO. It includes an overview of state and federal anti-discrimination requirements, examples of illegal housing discrimination and potential penalties, access requirements for people with disabilities, including reasonable accommodations and reasonable modifications, and best practices for housing providers. This training will be confirmed through completion of a short quiz. Please click here to register. You will be asked to create an account on the Ruzuku learning platform, then you’ll have immediate access to the training. If you experience any problems or have questions, please contact CVOEO at classcoord@cvoeo.org or 802-660-3455 ext. 205.

Tenant Selection: VHIP 2.0 participants have the right to select their tenants. However, the tenants they select must meet the program requirements, based on if they are enrolled in the 5- or 10-year tract (click here to learn more). For properties enrolled in this program, the property owner may not require a credit score greater than 500, and participants are limited to charging no more than one month’s rent for a deposit, regardless of whether it is called a security deposit, a damage deposit or a pet deposit, last month's rent, etc. Additionally, property owners must cover the cost of running background checks on potential tenants. Property owners are also required to accept any housing vouchers that are available to pay all, or a portion of, the tenant’s rent and utilities. Additionally, property owners must accept paper applications for tenants with limited internet access.

Out-of-State Owners: Out-of-State owners are required to identify a property manager located within 50 miles of the units to ensure a local, responsible party can manager the property in the absence of the property owner.

5-Year Grant Versus 10-Year Forgivable Loan

The primary difference between the 5-year grant and the 10-year forgivable loans are:

- The period for which the property owner must charge at or below HUD Fair Market Rent for the enrolled units (5 v 10 years)

- The 5-year grant option comes with additional tenant selection requirements to rent to a household exiting homelessness

To learn more specifics about these two options, review the sections below.

5-Year Grants

Any property, with the exception of tenant occupied units addressing code non-compliance issues, applying for VHIP 2.0 can opt to receive a 5-year grant. This compliance period will begin once the VHIP 2.0 unit is placed in service. This grant requires that:

- The unit is rented at or below HUD Fair Market Rent for the area for at least 5 years

- That the property manager work with Coordinated Entry Lead Organizations to find suitable renters exiting homelessness for at least 5 years or with USCRI to find refugee households to rent the unit to

Participants must sign a rental covenant to this effect. This covenant will be effective for 5 years and states that for this period, the unit must remain a long-term rental with a monthly rental rate at or below HUD Fair Market Rent and that the Department of Housing and Community Development must approve the sale of the property.

Tenant Selection: If the Department of Housing and Community Development (DHCD) or the Homeownership Center (HOC) that issued the grant determines that a household exiting homelessness is not available to lease the unit, the landlord shall lease the unit to a household with an income equal to or less than 80 percent of area median income. If such a household is unavailable, the property owner may lease the unit to another household with the approval of the DHCD or HOC.

Grant to Loan Conversion: A landlord may convert a grant to a forgivable loan upon approval by DHCD and the HOC that approved the grant. When the grant is converted to a forgivable loan, the property owner shall receive a 10% credit for loan forgiveness for each year in which the landlord participates in the grant program. For example, if the property owner participated in the grant program for 2 years prior to converting to a forgivable 20% of the funding will be forgiven, and the forgivable loan terms would apply for 8 years.

Note. This only applies to projects that received funding through VHIP 2.0. The initial VHIP funding was sourced from State Fiscal Recovery Funds, which had different regulations. The requirements and options outlined here do NOT apply to projects approved before March 25, 2024, and those grants can NOT be converted to forgivable loans.

10-Year Forgivable Loans

Any property applying for VHIP 2.0 can opt to receive a 10-year forgivable loan. This compliance period will begin once the VHIP 2.0 unit is placed in service. This grant requires that the unit is rented at or below HUD Fair Market Rent for the area for at least 10 years. The owner must rent the unit for 10 years at or below FMR to be forgiven in its entirety. Funds will need to be repaid to the State of Vermont for every year this requirement is not met i.e. if an owner only leases the unit for 7 years at or below FMR, 3 years (30%) of funding will not be forgiven.

VHIP Documents

VHIP 2.0 Resource Guide for Property Owners - This in-depth guide walks property owners through every step of the VHIP 2.0 process, from determining if the program is a good fit for your project, how to apply, payment disbursement, maintaining program requirements, to selling a VHIP 2.0 property.

VHIP 2.0 Recipient List - The identity of VHIP recipients and the amount of a grant or forgivable loan are public records and are published quarterly on this website.

Since there are several project types VHIP 2.0 supports, the Frequently Asked Questions (FAQs) are specific to the type of project applying for funding. To ask questions about your project, connect with your local homeownership center.

All property owners participating in VHIP 2.0 are required to charge rents at or below HUD Fair Market Rent (FMR) for the length of the agreement, depending on whether the property owner selects the 5-year grant or 10-year forgivable loan option. FMRs regularly published by HUD represent the cost of renting a moderately priced dwelling unit in the local housing market.

Fair Market Rent Calculator - To use the calculator, you must complete the utility worksheet, which indicates which utilities the tenant is responsible for payment. Once the utility worksheet is complete, the calculator will show the maximum allowable rent based on the county the unit is located in and the number of bedrooms.

Fair Market Rent Recertification Form - Property owners participating in VHIP 2.0 must submit a yearly recertification form to ensure they comply with the program requirements, including FMR. While the program requirements are in effect, property owners will receive an annual request to complete the recertification form. Property owners are encouraged to proactively complete this form upon turnover or lease renewal.

If you need assistance completing the recertification form or determining FMR for your area, please get in touch with your local Homeownership Center or the State Housing Division (VHIP@vermont.gov).

More Questions?

As this program matures, the Department is working to increase accessibility and answer eligibility questions. Additional information and answers to frequently asked questions will continue to be posted to this site as available. Click here to join our email list and stay up to date on Vermont Housing Improvement Program 2.0 updates and news.

Connect with your local Homeownership Center to learn more about VHIP 2.0 and receive application assistance.

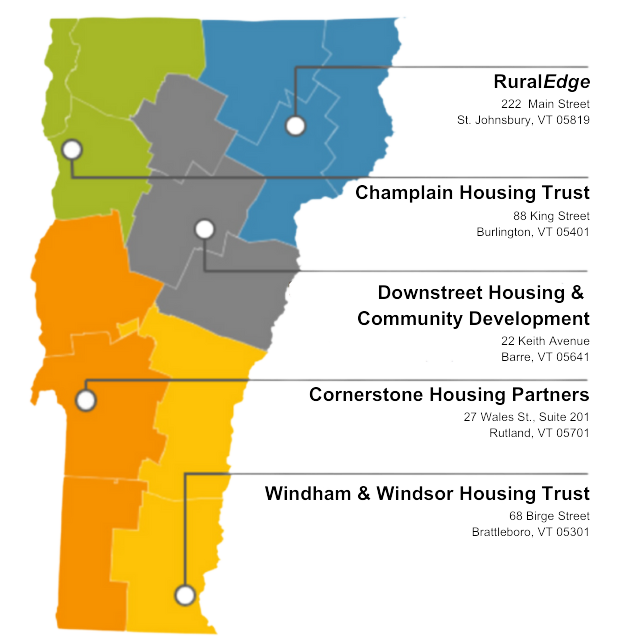

RuralEdge - Caledonia, Essex, and Orleans Counties

-

Email rentalrehab@ruraledge.org or call 802-473-3919

Champlain Housing Trust – Chittenden, Franklin, and Grand Isle Counties

-

Email vhip@getahome.org or call 802-861-7389

Cornerstone Housing Partners – Addison, Bennington, and Rutland Counties

-

Email info@nwwvt.org or call 802-438-2303

Downstreet Housing & Community Development –Lamoille, Orange, and Washington Counties

-

Email RCarpenter@downstreet.org or call 802-477-1330

Windham & Windsor Housing Trust – Windham, and Windsor Counties

-

Email jcravinho@homemattershere.org or call 802-246-2126