An income statement is also known as a profit and loss, P & L, or statement of revenue and expense.

An income statement shows:

- the revenues/sales before expenses/deduction, and

- the business expenses/deductions for a specific period of time.

Trust taxes (Sales Tax, Meals and Rooms Tax, Property Transfer Tax) that you collect from customers are not included as your business’ revenue and should be excluded or separated out from your revenue statement. The revenue minus the expenses equals the net profit or loss for that period of time. An income statement report should use either cash basis or accrual basis. You may use accounting software, spreadsheets, or other document programs to prepare an income statement. The tool used is less important than the format. The format should be (listed from top down): revenue first, expenses next, and net profit or loss last.

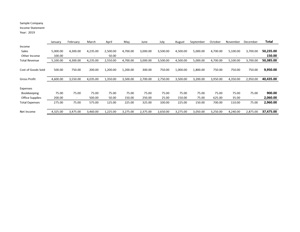

Creating a Monthly Income Statement

Multiple periods, such as twelve months, may be shown on one income statement report, as long as there are columns for each monthly period listed horizontally, with a total column on the far right for all months on the report. A twelve-month income statement report would have thirteen (13) columns: January, February, March, etc. through to December, as well as a total for all twelve months. Alternatively, you may have separate pages for each month.