For Immediate Release

Tuesday, February 6, 2024

GOVERNOR SCOTT ANNOUNCES FIRST ROUND OF VENTURE CAPITAL PROGRAM INVESTMENTS TO HELP VERMONT ENTREPRENEURS AND BUSINESS STARTUPS

Montpelier, Vt. - Governor Phil Scott, the Department of Economic Development (DED) and the Vermont Economic Development Authority (VEDA) today announced the first round of Venture Capital Program investments thanks to Vermont’s State Small Business Credit Initiative (SSBCI). The Venture Capital Program is allocating nearly $29 million to venture capital funds to help Vermont entrepreneurs and business startups.

“Vermont has a strong start up culture and the Venture Capital Program is only going to help it grow,” said Governor Scott. “The Venture Capital Program will help maximize the potential of Vermont’s creative and energetic entrepreneurs, and will fuel our economic growth, benefiting the entire state.”

Venture Capital Program recipients will use the SSBCI funds on seed fund investments; leveraging accelerator programs to make small investments in rural, pre-seed stage companies; and investments in high-growth, technology innovation companies in the healthcare sector.

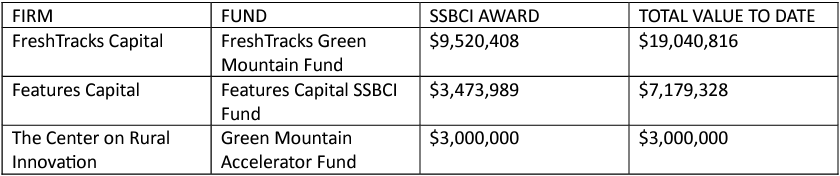

In this first round, commitments are as follows:

“FreshTracks is excited to participate in this program, matching private investment capital with the SSBCI public funding to launch a new $19 million venture fund called the FreshTracks Green Mountain Fund. This unique program allowed us to raise our sixth venture capital fund in half of the time it would normally take”, said Cairn Cross co-founder and managing director of FreshTracks Capital. “We expect to invest in at least 20 start-ups and early-stage Vermont-based companies during the next five years with this new investment vehicle.”

“The Small State Business Credit Initiative is a tremendous opportunity for economic development in a rural state like Vermont,” said Joan Goldstein, Vermont Economic Development Commissioner. “We are grateful for VEDA’s partnership to disburse these SSBCI funds so they can be used to create high-quality jobs and expand economic opportunity.”

There is still $12.5 million in funds remaining to be allocated via the Venture Capital Program and VEDA may select more than one fund manager to manage it.

“The SSBCI venture capital program implemented by VEDA is a unique opportunity for Vermont’s venture capital eco-system to increase investment in earlier stage companies that demonstrate promise to grow, diversify and strengthen Vermont’s economy,” said Cassie Polhemus, CEO of the Vermont Economic Development Authority. “VEDA welcomes proposals from venture capital fund managers that bring depth and breadth of experience in the start-up community and will provide support and advisory services to guide founders with critical decision making through the stages of growth.”

Potential applicants can reach out to VEDA via email about the Venture Capital Program Request for Proposal (RFP) form until February 16, 2024. The deadline to submit a proposal is March 1, 2024, at 1:00 p.m.